Many of us view our insurance policies as something that is always there to protect us, and our insurers as an extension of that protection. Yet in reality, insurance companies are a business. Their job is to make a profit — not to give away money.

Insurance companies that offer long-term disability insurance are no different. Insurers often go to great lengths to prove that you are not really disabled. This is often done through surveillance and other tactics.

If insurance companies “catch” claimants doing activities that they believe are inconsistent with their disability claim, then they will deny benefits. That is why surveillance is a winning proposition for insurance companies: it presents the opportunity to save a substantial amount of money.

Unfortunately, most types of surveillance are legal. That leaves it up to you, as the claimant, to make smart choices so that you are not ensnared by a trap set by the insurance company. Read on to learn more from an experienced Philadelphia long-term disability insurance lawyer.

Common Types of Surveillance Used

Insurance companies will use a number of tactics to “spy” on claimants. As an initial step, an long-term disability (LTD) insurer may hire investigators to perform background checks to learn more about you. This information — including your address, the type of car you drive and who lives with you — will then be used for further surveillance.

From there, an investigator will often park outside of your home and use a small camera to take pictures and videos of you. If you leave your house, he or she may follow you and video your activities. They’ll take note of how often you leave your house, what you do when you go out, and what you are wearing and carrying when you leave.

For example, if you are wearing high heels or carrying heavy items, the investigator may snap pictures. Even if your activities are mundane, such as taking light groceries from your car to the house, investigators will note whether you walked with any disturbance or looked comfortable and walked easily. Their observations can be damaging even if your disability is unrelated to whether you can carry a bag of groceries into your house.

This type of evidence can be used to deny or terminate your claim. This is particularly important if what you are doing seems to contradict what you claimed on your long-term benefit application. For example, if you claim to have a severe neck problem and are spotted taking vigorous dance classes, that may disprove your claim.

More concerning, even if you are only recorded pulling weeds for a few minutes, or opening your mailbox, this pretext can be used as evidence against you. Video-surveillance may only consist of a few minutes over several days (sometimes less than 30 minutes of recordings will be made over a three day period or more). Yet this limited footage may be given to one of the insurance company’s doctors who will undoubtedly rely on it to say you seem fine.

Next, the investigator will do an online search to see if you have been engaging in other activities that may show that you are not disabled. This is often shown on social media accounts such as Facebook, Instagram, or Twitter.

Even if you are not posting pictures or status updates; comments, check-ins, and other seemingly innocuous activity could be used as evidence against you. Even updating your profile picture on a locked facebook account can show activity the insurer will attack (was that updated pic a group picture at a family member’s wedding?).

If it seems arbitrary, it largely is. But LTD insurance companies have every incentive to look for anything they can to support a denial.

Is Surveillance Legal?

As a general rule, this type of surveillance is legal. A background check will typically use publicly available information, or data that can be purchased for a small fee. Similarly, information found online — such as what is on your Facebook profile — may be public or easily accessible.

Video and photo surveillance are also usually legal, provided that you are in a public place. If the investigator attempts to photograph or take a video of you when you are inside of your home or another private place, or trespasses on your or someone else’s private property, then it would cross a line. But simply videotaping you or photographing you in public is not illegal, even if it is your front yard.

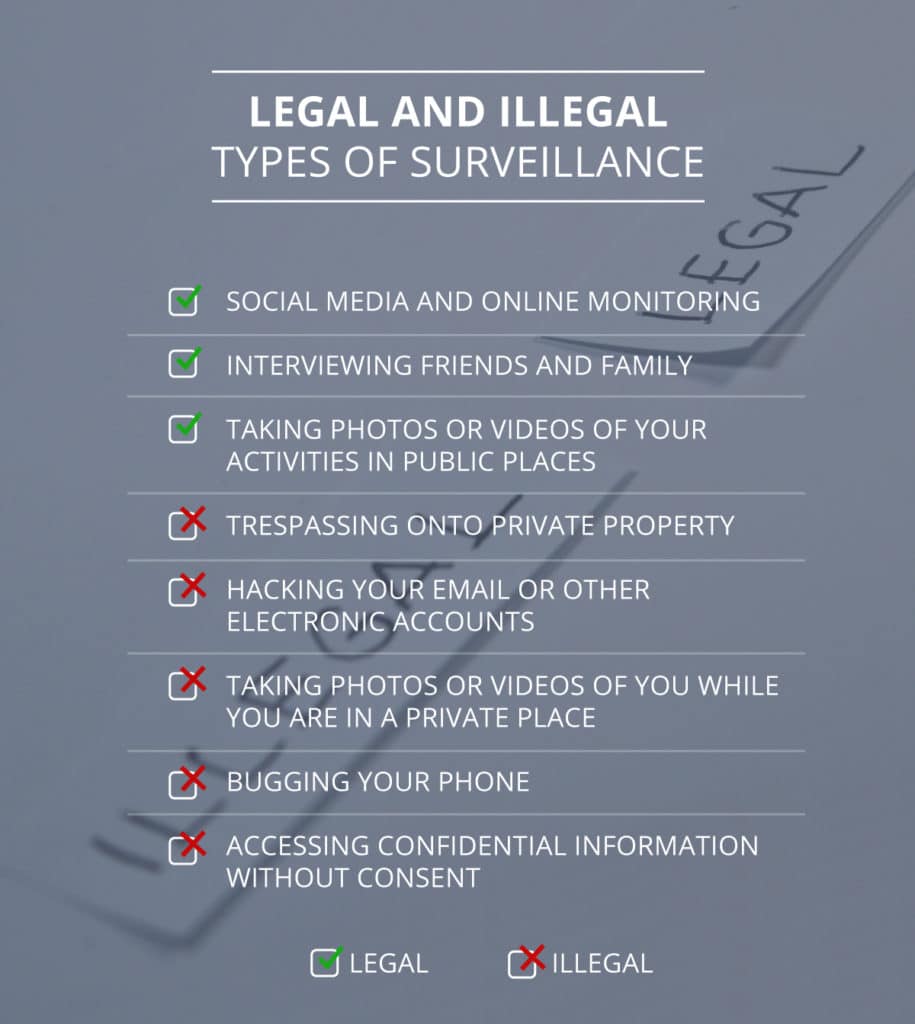

The following are types of surveillance that may occur if you have filed a disability claim:

- Social media and online monitoring: legal

- Interviewing friends and family: legal

- Taking photos or videos of your activities in public places: legal

- Trespassing onto private property: illegal

- Hacking your email or other electronic accounts: illegal

- Taking photos or videos of you while you are in a private place: illegal

- Bugging your phone: illegal

- Accessing confidential information without consent: illegal

How to Increase Your Chances of Success

The best way to maximize the likelihood of a favorable outcome for a long-term disability benefits application is to be honest. If you lie about or exaggerate your condition, there is a good chance that someone — such as the insurance company’s investigator — will learn about it. In that case, you may find yourself being denied benefits.

Beyond being honest, you should also take care in your daily activities not to exert yourself beyond your limits. This is not the time for heroic activities.

Instead, you should assume that you may be watched. We know that everyone has good days and bad days. Even if you have a debilitating condition, there might be a day where you feel up to going for a walk, or pulling those pesky weeds out of your driveway — resist that temptation, or at a minimum, make sure that what you’re doing is consistent with what you’ve claimed.

Insurance companies will look for any reason to deny your claim. You are better served by being cautious in your day-to-day activities until your case is approved.

The same goes for your online presence, including social media. Even an innocent post, where you are smiling and laughing outside, could be used to try to argue you are not as limited as you contend. Consider limiting your public posts and minimize your public-facing profile until your claim is approved.

More importantly, if you are attending activities where friends and family might tag you in photos showing you more capable than you allege, you should consider what you’ve told the insurance company about what you can and can’t do, and reconsider your involvement.

Related: Do You Have to Answer Insurance Company Requests for Documents? Learn More.

Work with a Philadelphia Long-Term Disability Insurance Lawyer

The process of being approved for long-term disability benefits can be arduous. Even when your case seems clear-cut, the insurance company may want what seems like a mountain of evidence — and may even spy on you to make sure that you aren’t just making it all up.

At Bross & Frankel, we understand how challenging this time can be for our clients. With more than 50 years of combined experience, our Philadelphia long-term disability insurance lawyers understand how to put together a strong case for benefits. Contact us today to schedule a free claim review at (856) 795-8880, or reach out to us online.

Rich Frankel is the managing partner of Bross & Frankel. He is a member of the New Jersey and Pennsylvania bars. He has focused exclusively on disability and social security benefits since 2005.

Mr. Frankel joined what is now Bross & Frankel after having watched his father struggle with disability, fighting a lengthy illness. Mr. Frankel founded the firm’s veteran’s law practice and substantially grew the social security disability practice, focusing Bross & Frankel’s ability to fight for all of the disability benefits available to his clients.

Mr. Frankel additionally fights for clients in court, obtaining frequent victories in Social Security appeals and against insurance companies in Federal court.